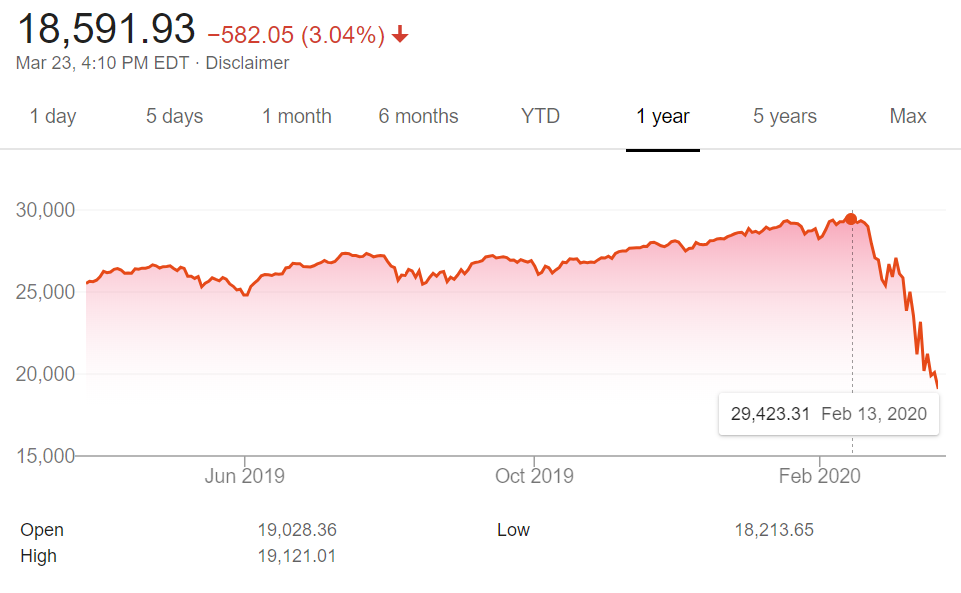

As businesses shuttered across the globe with governments responding to the coronavirus crisis by issuing shelter-in-place orders that restrict all but essential travel, financial markets are in a precipitous free-fall.

401(k) plans are losing trillions of dollars as global equity markets are reset by widespread economic disruptions. In an attempt to stop the bleeding, the Federal Reserve announced unprecedented emergency fiscal measures at 8 a.m. on Monday, March 23.

The central bank will begin issuing open-ended, unlimited liquidity, also known as Quantitative Easing, and the Fed announced it will purchase securities and bonds “in the amount needed to provide liquidity to the market.”

The kitchen sink response comes after the S&P 500 retreated from a high of $3,386.15 on Feb. 19 to $2,304.92 on March 20, a loss of 32% in a month.

Futures markets were halted limit down minutes after open on Sunday, March 22 after U.S. Senators failed to pass a relief package by late afternoon. Rules designed to slow momentum force domestic futures markets to stop selling when prices reach 5% below the prior close.

Trading limits were strengthened after the Black Monday crash in 1987 that saw a 22% loss in one day of trading. A 7% decline automatically triggers a 15-minute pause, after that a 13% loss prompts a second 15-minute halt, and following that a 20% loss ends trading for the rest of the day. The 13% marker has not been breached, so far, but the markets lost 12.9% Monday, March 16.

Before the recent sell-off, markets triggered 7% circuit breakers only three times due to trading losses: once in 1997, once as a result of 9/11, and once on Dec 1, 2008, during the financial crisis.

The current state of chaos has already manifested four limit-down halts: March 9 (with the S&P ending the day -7.6%) , March 12 (-9.5%) which at that time was the worst day since Black Monday, only to be surpassed four days later on March 16 (-11.98%), and circuit breakers were triggered again on March 18 (-5.17%).

Oil prices peaked at $63.27/barrel on Jan. 6, but after dropping to $20.37, energy stocks have cratered. The silver lining is that gas prices will be coming down as a result, but oil and energy are preferred investments for many money managers, and 401(k) plans are being devastated by the rout.

Domestic oil producers are being squeezed by low prices, and retail markets and home sales in Texas and other regions dependent on oil production proceeds are strained when profits fall. Financial experts warn that what we are witnessing in markets is just the tip of the iceberg, and expectations of recovery are muted while the economy remains at a virtual standstill.

Investors are desperately seeking a safe-haven in an environment where all asset classes are being hammered.

The Senate is negotiating a multi-trillion dollar relief package that includes hundreds of billions to backstop industries, but ideological differences are preventing Republicans and Democrats from agreeing to the package.

As the McConnell plan is based on 2018 tax returns and includes upper and lower thresholds for receiving assistance, critics argue that limiting payments to individuals and families with no tax liability is detrimental to those that most need support. Americanprogress.org reports, “The result of this structure is that some of the hardest-pressed families will receive much less than people above them on the income scale.”

The Hill reports that Senate Republican John Thune said, “While this won’t solve all the problems our nation is facing overnight, cash payments to middle and low-income families will provide direct support as quickly as possible.”

Democratic Senator Tammy Duckworth told CNN, “The package Republicans have drawn up does nothing to help struggling workers…first responders need personal protective equipment and resources today…and there’s nothing in it for them. Instead, it creates a $500 billion slush fund for Steve Mnuchin to hand out loans to corporations as he pleases.“

Senator Duckworth demanded that the bill include provisions that benefit working-class Americans by saying, “There is nothing in this bill that they propose that will protect people who can’t…make payments from being evicted. There’s nothing in this bill that protects students from student loan debt. Instead, this bill is all skewed to corporations, skewed toward a slush fund that Steve Mnuchin can write checks to whoever he wants, without oversight, even to Trump organizations.”

The Former Secretary of Labor under Bill Clinton and economic advisor for Barack Obama, Robert Reich, tweeted, “The airlines don’t deserve a $50 billion bailout. In the last 10 years, they spent 96% of their cash flow to buy back shares of their own stock in order to boost executive bonuses. They shouldn’t see a dime of taxpayer money.”

As reported by the Financial Times, Boeing recently spent $43 billion on stock buybacks, the “very purest form of financial engineering…they don’t simply gear the balance sheet, they supply a further twist by reducing the number of shares in issue.” The “biggest winners are managers, especially those whose remuneration is tied to stock market measures such as EPS growth.” According to the report, CEO Denis Mulinberg doubled his pay since becoming the executive officer in 2015, and he took home more than $30 million in 2019. Now the beleaguered company is asking taxpayers for a $60 billion bail-out.

Senators Chuck Schumer and Bernie Sanders attempted to put restrictions on corporate stock buyback programs in 2019.

Forbes is reporting that Jeffrey Dunlach, CEO of DoubleLine Capital, said a recession is imminent, and he continued, “When you decimate the restaurant industry, the hotel industry, the airline industry, the cruise line industry, obviously you’re going to take a huge divot out of economic activity.”

Billionaire investor Bill Ackman shocked the markets on Wednesday, March 18 by pleading on CNBC, “Mr. President, the only answer is to shut down the country for the next 30 days and close the borders.” Ackman called for a “30-day rent, interest, and tax holiday for all,” as he warned that “hell is coming.”

![[Both photos courtesy of sonoma.edu]

Ming-Ting Mike Lee stepped in as the new SSU president following Sakakis resignation in July 2022](https://sonomastatestar.com/wp-content/uploads/2024/04/CC4520AB-22A7-41B2-9F6F-2A2D5F76A28C-1200x1200.jpeg)