Throughout March and April, Sonoma State University partnered with Wells Fargo to do a series focusing on money management. While enrolled in college, many students do not think about what comes after college, and how to pay off student loans. According to Student Loan Hero, “about 69% of students from the Class of 2019 took out student loans, graduating with an average debt balance of $29,800.”

On Weds. April 21, SSU hosted “Noma Nation Money Matters: Paying for College and Student Loan Repayment Workshop” in hopes of providing students with the necessary tips to pay for college and repay their student loans.

Mo Phillips, director of student involvement, was excited to put on this event, as she hoped to provide students with the proper tips and resources necessary to repay their student loans in the future. “Personally, I made a lot of these mistakes when I was in college and it took a long time to get out from under the debt I accrued at that time. We want to make sure that SSU students do not make these same mistakes and are thinking about this area of their lives,” Phillips said.

By putting on this money management event, SSU faculty hope to remind students that they are not alone when it comes to paying off student loans. “It is important for students to understand their many options when they enter loan repayment. Students should know how much they borrowed and who their lender or loan servicer is,” Director of Financial Aid Shanon Little shared.

Little wanted to remind students that these loans should never create a financial hardship for them. She went on to say that “the main thing to do is reach out to your loan servicer if repaying these loans becomes hard for you. Your loan servicer will want to work with you by talking over your options, ranging from suspending payments temporarily or entering into a different repayment plan.”

Budgeting is one of the main ways that students can help themselves pay for college. It is important for students to sit down and know exactly how much the various aspects of college will cost them, taking into account the prices of tuition/fees, room/board, and books/supplies.

Graduating early, if possible, might be an ideal option for students to save money. Meeting with an advisor would be a great way for students to ensure that they are on the right/most efficient track for graduation.

“Make sure you have an academic plan laid out and stick to it. The less time you spend as a student, the less amount of money you will need to borrow,” Little recommended.

Phillips shared a plethora of tips for students to pay for college and repay their student loans. She recommended that students make sure to, “set up a plan for themselves. Do research on funding sources on and off campus, work with their lender and campus representatives to see if they can help with planning, be aware of when they are supposed to pay back loans and make the payment, and lastly talk to a Financial Aid representative as they may know of some funding sources to best assist them.”

In addition to student loans, there are also other ways students can pay for college, such as grants or scholarship money. In order to consider all of their options, students are advised to look into these opportunities first to see if they are eligible.

At SSU, scholarship applications for the upcoming Fall semester are typically available to students between Nov. 1 and Feb. 1 each year. “Each year, SSU offers internal scholarships ranging from $500-$5,000” Little shared.

Aside from finding scholarships through SSU, another great way to find the one that works for students is by seeking out external scholarships. “Local organizations such as Rotary, Kiwanis, and area foundations tend to be where I see students receiving the most scholarships,” Scholarship Coordinator Sara Golightly shared.

Phillips finished up by letting students know that “… there are many people on campus that can help with some of these conversations, so talk to them! We will be continuing this series in the fall to continue providing students with more information on paying for college.”

The “Money Matters” event left students with a lot of information on how to plan their academic journey financially, without any bumps in the road.

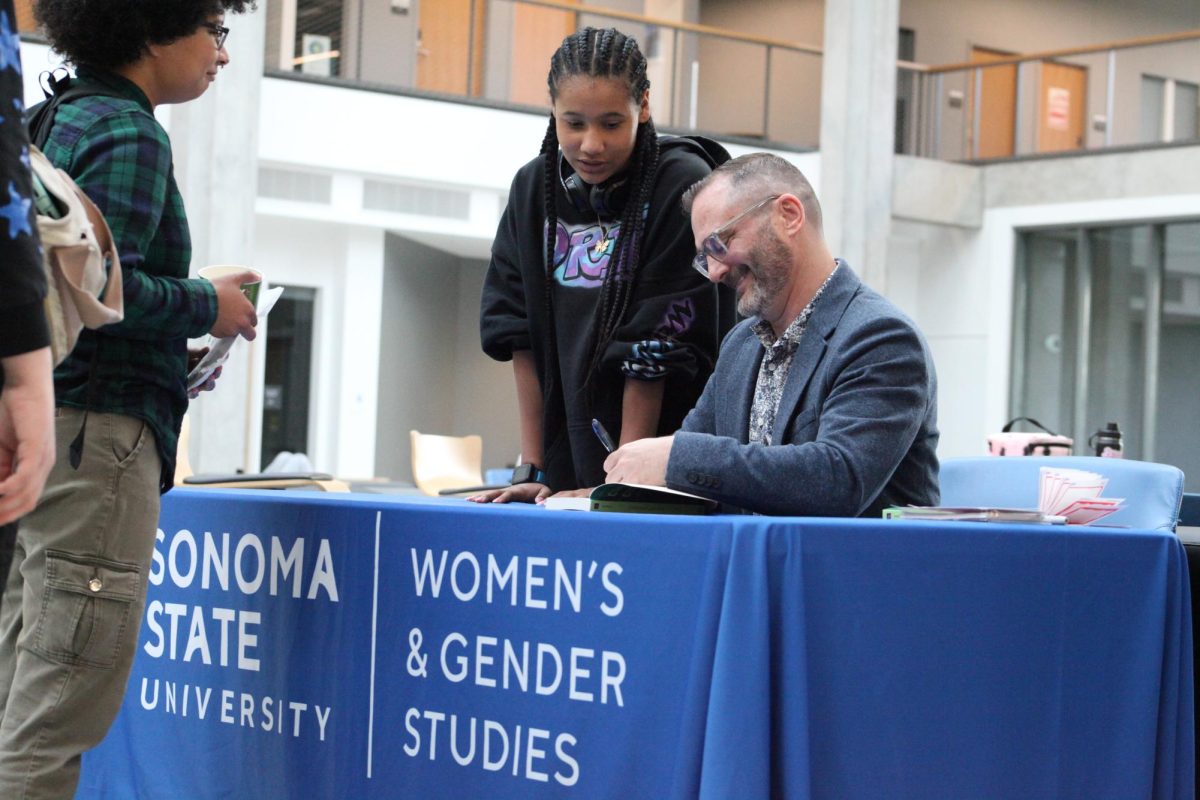

COURTESY // Sonoma State University

Noma Nation’s “Money Matters” event aimed to provide students info on budgeting, financial planning, and repaying their student loans.