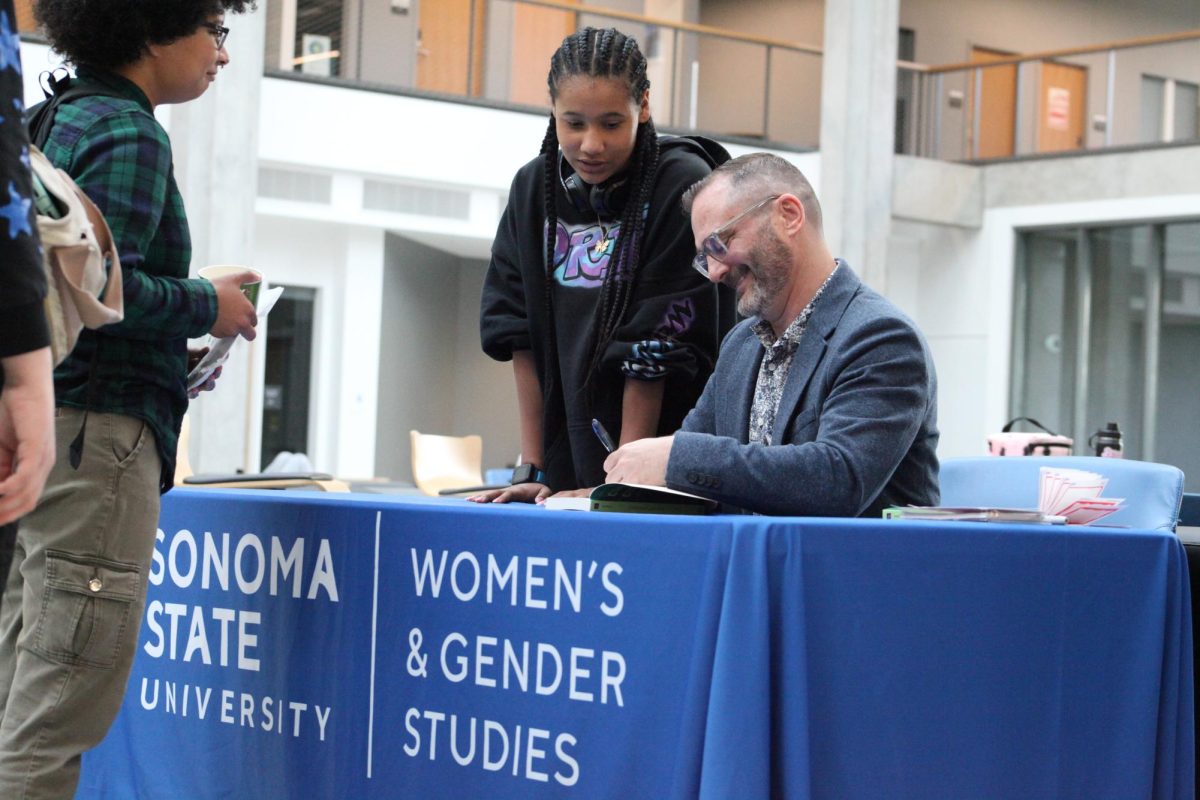

Jean Chatzky visited Sonoma State University last Thursday to give advice about financial literacy and financial wellness. Chatzky is the financial editor for NBC’s “Today Show” and is a best selling author for multiple books, including“Money Rules: The Simple Path to Lifelong Security”, which was handed out after her talk. She teamed up with Redwood Credit Union to help guide those in need of financial advice.

She enthusiastically spoke to the audience and related her own struggles to what many Americans experience. “Money is an uncomfortable issue for many,” Chatzky said. “More than half of Americans are insecure about it.” She discussed loans, credit, debt, retirement and investing. She said each person has different struggles and issues with finances so she was able to givea broad overview of important knowledge.

She referenced her book “Money Rules” quite frequently. It gives straightforward advice and includes 94 rules to help lead those to financial security. Chatzky emphasized important rules from her book that can help improve one’s financial situation. The first being makinga decent living. Descent, as in comfortable living including be able to pay rent, purchase food and gas and even a vacation as well as save, with no worries.

Another rule Chatzky discussed is related to rule number62 from her book, is to spend less money than you make. She mentioned that life is different from the past, expenses have changed. Chatzky said many struggle with materialistic satisfaction and one’s brain gets more aroused from that and does not light up when it comes to one’s future and retirement. “Money and love make people behave in ways that don’t make sense, and logic goes out the window.”

“For some, money means power or security and sometimes makes perceptions and values change,” said Chatzky. One has to trick their brain into doing the right thing and avoid sporadic, irrational spending.

Chatzky talked about rule number18 which is that onewill spend more with credit than debit, and more with debit than cash. “Keep big bills in your wallet,” Chatzky said. With 50’s in awallet, one is less likely to break the bigger bills and avoid the small unnecessary items.

She briefly touched on number6 which is investing diversely. She said owning bonds and stocks are helpful for security as well and It’s important to keep emotions in check when it comes to one’s money and investing. “History teaches us, cashing out of the market doesn’t work, but uncertainty or fear kicks in,” said Chatzky.

She did not direct a lot of information to students in college or soon to graduate but she did emphasize the importance of paying all bills on time, every time. She said it’s important for everyone to check their credit score because it determines interest rates, cars, homes and even some jobs. “Every birthday, check your weight and credit score, one should be going up,” said Chatzky.

She concluded with the importance of giving back, that gratitude is the key. Something mundane, one should view as a gift. Chatzky strongly urged those who are lost to seek financial guidance. It is important to know everything about your finances and will help one into lifelong financial security.