Sonoma State University wine business students collaborated with Terra Fossil Wines and Oliver’s Market stores for a cause marketing project called “Stomp Out Student Loans” to raise money towards scholarships and supporting students with college debt.

For each $9.95 bottle of Terra Fossil wine sold at Oliver’s, both companies will donate a combined total of $2 to the scholarship departments of Sonoma State and Santa Rosa Junior College.

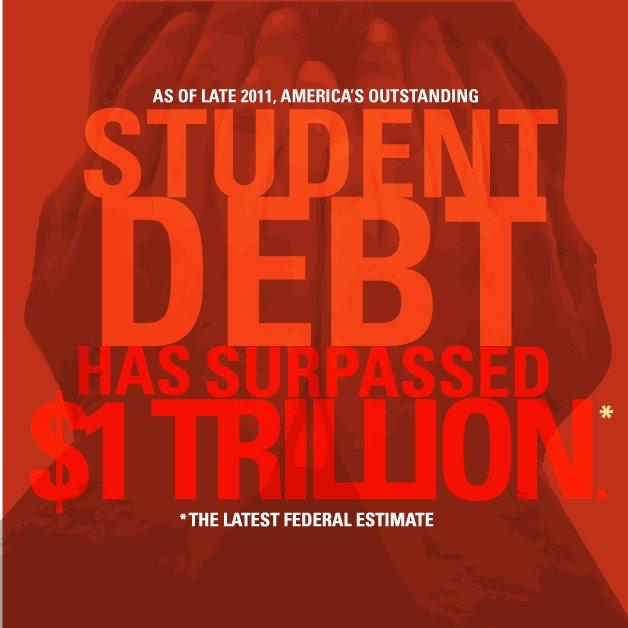

Student loan repayment debt is a growing national issue with roughly $1.2 trillion in debt to date. The debt is currently bigger than the national credit debt at $800 million.

CEO of Terra Fossil Wines Greg Lieb said the partnership is a unique and exciting opportunity to support students in paying their college loans on a local scale here at SSU and SRJC.

“It’s probably not done that much in the U.S. yet, to have a university connect with a retailer and then have products that give back to the university to stamp out student loans and create scholarships. It makes sense,” said Lieb.

Creative Director Andy Kuspon acknowledges the severity of the problem and intends for the project to expand into the future.

“We want to get this message out to more universities, to more cities. This is not something that we will do for 30 to 60 days and it’s done,” said Kuspon.

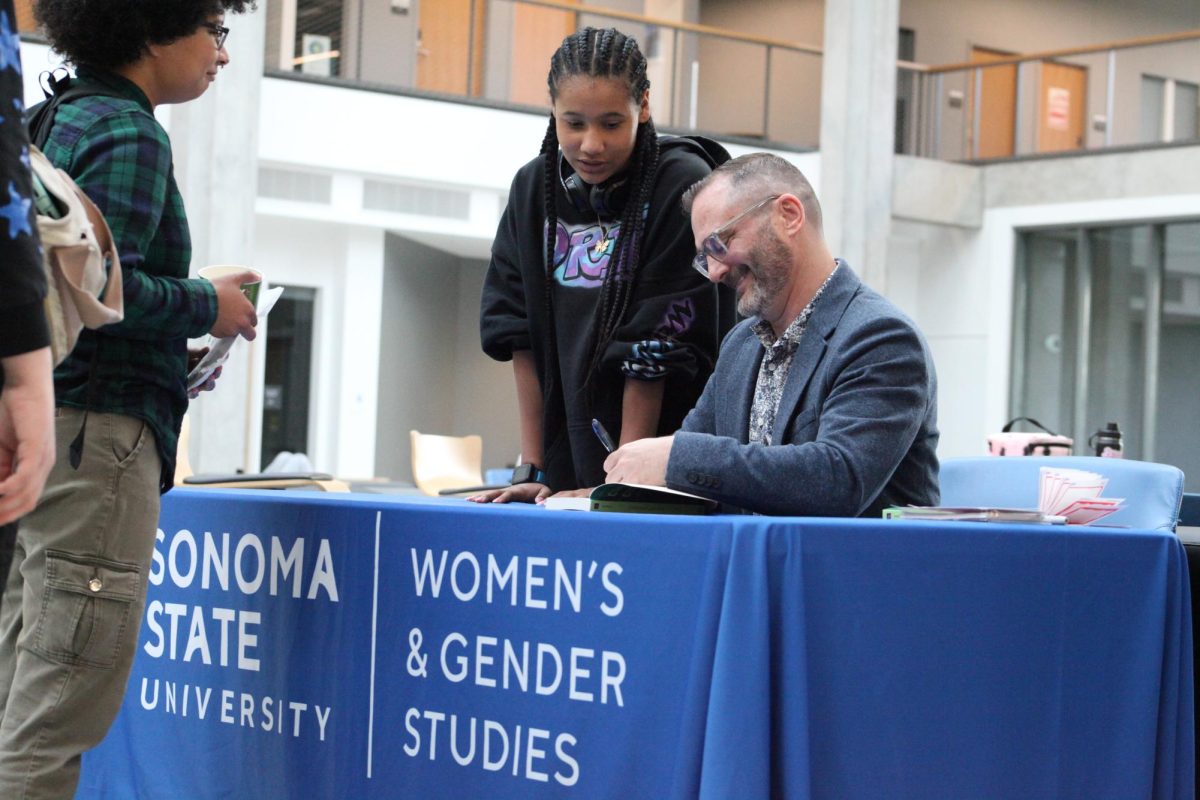

Sonoma State Wine Business Professor Liz Thach was excited to partner her class with Terra Fossil Wines to create a more relevant learning environment that “comes alive” for the students.

“I’m excited. I want to unleash students’ creativity and see what they come up with. A lot of them are excited because it’s real world; it’s something they can talk about in interviews with employers,” Thach said.

Supplementing the project’s learning opportunities, Thach is supportive of Terra Fossil’s campaign to stamp out student loans and the debt that is “demoralizing” for students.

“It’s not right to have our graduates finishing with this huge debt on them,” Thach said.

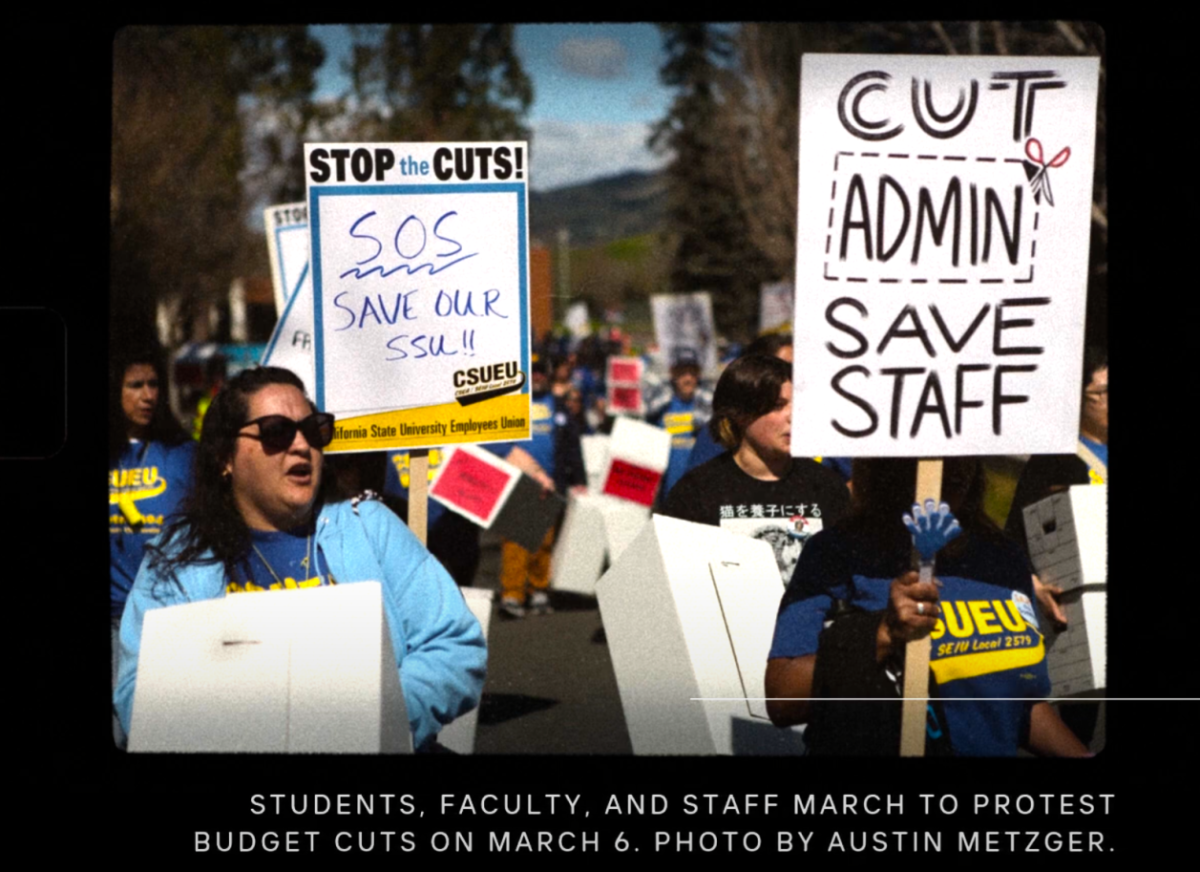

According to Senior Policy Analyst at Young Invincibles Christina Postolowski, state governments across the U.S. are investing less into higher education and college costs are on the rise. These are both contributing factors to increased student loan debt.

“We want all students from all backgrounds to have access to higher education. The student loans piece and the repayment measures are one piece of a bigger puzzle,” said Postolowski.

A proposal drafted in March by a consortium of higher education organizations on the issue outlines a reform to improve the current loan repayment process. The consortium consists of Young Invincibles, the National Association of Student Financial Aid Administrations (NASFAA), Institute for higher Education Policy (IHEP) and New America Foundation and HCM Strategists.

The proposal outlines the need to shift toward income-based repayment on federal student loans utilizing an employer-withholding system. Postolowski advocates how a revised repayment model will be more beneficial for borrowers in comparison to the current, complex 10-year repayment model.

“The process isn’t easy enough for students to get into. That’s where we think having an automatic option where have a monthly repayment is a better status quo than the one we currently have,” said Postolowski.

Last year, Congressman Tom Petri introduced a similar proposal, the Earnings Contingent Education Loans (ExCEL) Act in Congress. However, Postolowski states the bill is “missing some important protections for students” including an end to the payment period and a cap-off interest rate to further support borrowers.

The lack of education about student loan repayment and the financial aspect of college is a central problem within in higher education according to Postolowski. A recent survey by the Young Invincibles found that 40 percent of students said they didn’t get entry counseling, a mandatory requirement set by the Department of Education.

“While they probably received the counselling, this tells us that it (the counselling) didn’t make an impact. There is certainly something to be done to foster the entrance and exit counseling for those students who require it,” Postolowski said.

In the meantime, Postolowski encourages both students and institutions to use the resources currently available to become more aware of the process of student loan repayment.

“Something that students themselves can do is get more information, go to the Department of Education’s website, find out how to enroll if this is something they need. The schools should be making sure students, before they graduate, get enrolled before they start paying debt,” Postolowski said.