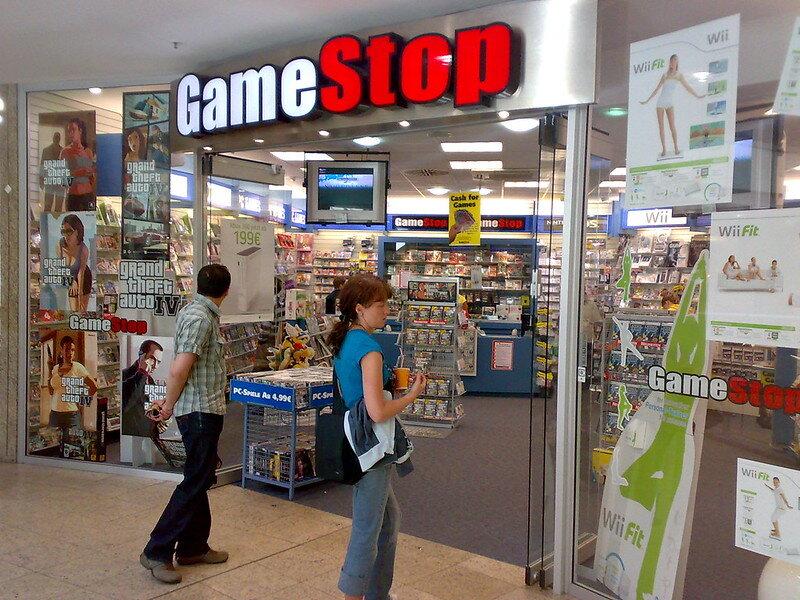

On January 27, 2021, GameStop’s publicly traded stock skyrocketed to a price of $347.51 per share, which was $328.51 more than the value of the stock only ten days before. In a matter of days, GameStop’s market cap reached $33.7 billion, up from $1.2 billion at the end of December. This massive surge was primarily due to users on the social media platform Reddit intentionally driving up the stock price. Reddit is an online community where people can meet to talk about their interests in forums, a plethora of these communities based around trading stocks.

COURTESY // STEPHAN MOSEL

With users beginning a ‘Reddit Rally,’ which was a Reddit movement that strongly encouraged users of the Robinhood stock service to buy the stock en masse. A popular subreddit page, called Wall Street Bets, with a following of 2.2. million at the time of the stock surge rallied its users to purchase massive amounts of the GameStop.

Robinhood investors have been stereotyped as amateur millennial investors who are too lazy to research the stocks they are buying. However, investors may have some advantages over older hedge fund shorters and traders alike though, with events such as the ‘Reddit Rally’ they are able to better plan out their trading. They have demonstrated their ability to coordinate a large-scale purchasing of one stock, which proved to be a catastrophic weapon. With more than 7 million users, Reddit now has the numbers to create massive stock surges at will.

To fully understand why this surge was a significant win for small investors and a substantial loss for big players, one must first understand shorting. As described by Oxford Languages, shorting is when someone “sells stocks in advance of acquiring them, with the aim of making a profit when the price falls.” Many significant investors will put their money into failing stocks with plans to ‘short’ them later on for a profit.

Before the stock surge, Melvin Capital, a prominent hedge fund investor, shorted the GameStop stock. Former Chewy CEO Ryan Cohen joined Melvin Capital in 2020, which brought special attention to the table, all eyes on the growing hedge fund. Andrew Left, part of another group shorting GameStop, Citron Research, said he covered his short position “at a loss, 100%.” Multiple organizations had planned to short GameStop at an increase to their wallets and at a detriment to the stock. GameStop’s stock has been on a decline for the past five years, so shorting this stock seemed like a safe bet before the ‘Reddit Rally.’ So, when the subreddit grew in popularity, it was able to make an impact.

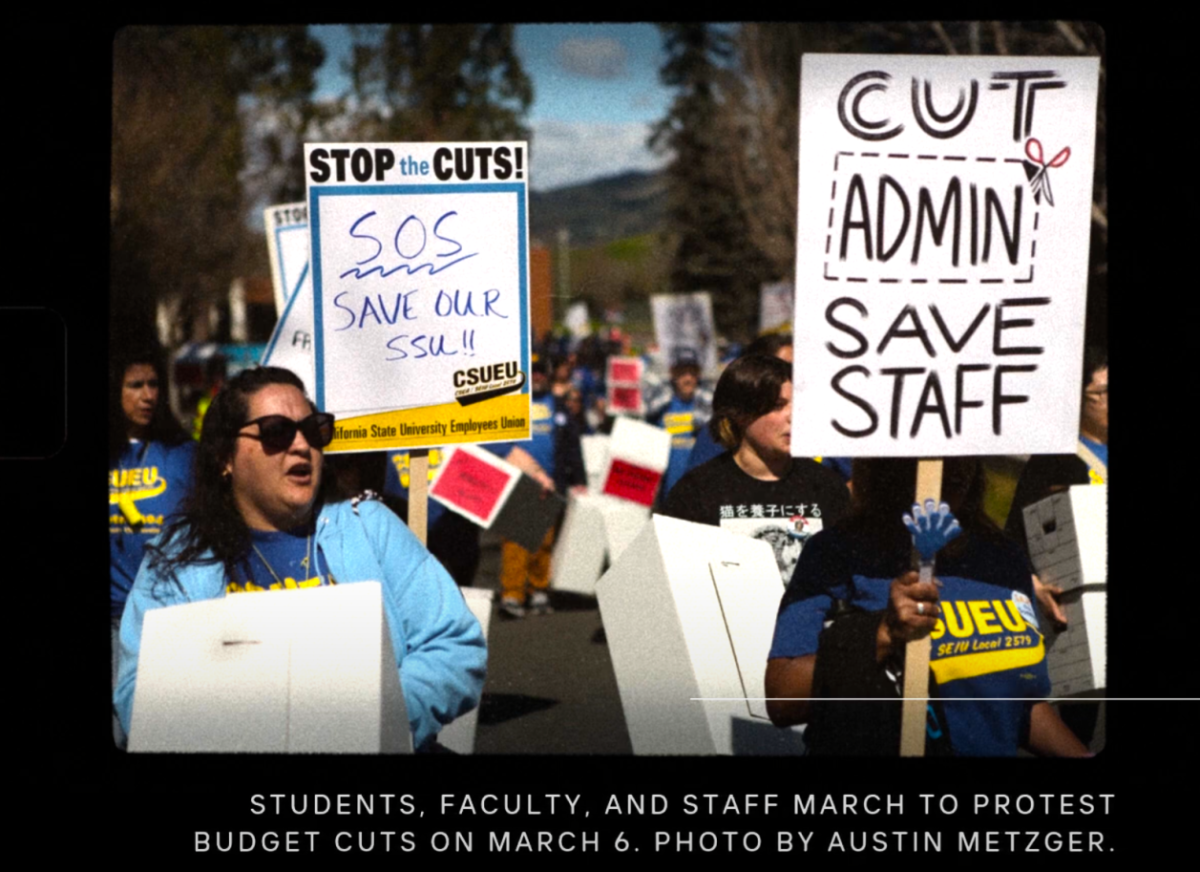

GameStop stock trading got so popular on stock trading apps, such as Robinhood, that the app limited the number of shares users could purchase. “The table below shows the maximum number of shares and options contracts to which you can increase your positions,” Robinhood stated on January 31. “These limits may be subject to change throughout the day.” The limit meant confining users to purchasing only one GameStop stock. This cutoff from the trading app led to the decline of the stock price for a short while. Reddit users were not done though as the stocks rose again when restrictions eased. Since January, the stock has once again increased to $206.20. While it is unclear what the ending of this Robinhood Rally will look like, one thing is certain; Robinhood investors won this round.

App-based traders have been put down a lot lately because of their illegitimacy; they are still an unknown player in terms of the stock market. After raising the GameStop stock price so high in such a short period of time, they are earning respect from more prominent names. All the while, they are making a decent amount of money from their inflation of the stock prices.