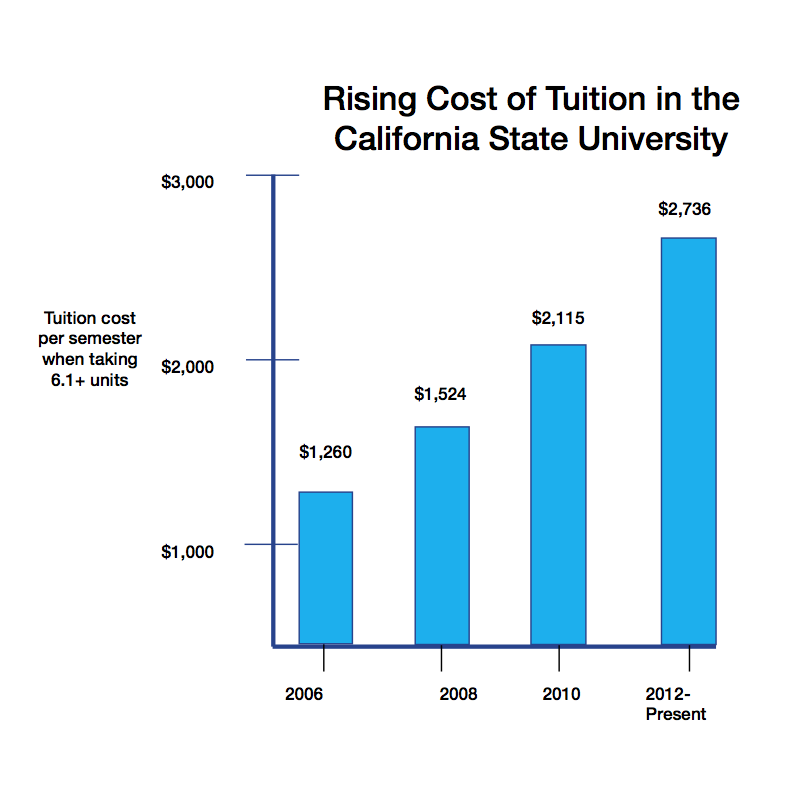

For the 2015-16 academic year, full-time tuition costs Sonoma State University students roughly $3,665 for the fall semester and $3,667 for the spring semester. Out-of-state students have to pay an additional $372 per unit. Paying for college is extremely costly — but thankfully, there are multiple opportunities for students to apply for both financial aid and scholarships.

One of those opportunities is the FAFSA, or the Free Application for Federal Student Aid, which gives students the opportunity to receive federal and state aid to offset the costs of higher education. The FAFSA deadline is quickly approaching, with the priority deadline of March 2.

Susan Gutierrez, director for the Office of Financial Aid at Sonoma State has worked in the Financial Aid Office since 2000 and is informed about the whole process of applying for FAFSA.

“All students who meet the basic eligibility criteria will qualify for the federal Direct Loan program,” said Gutierrez. She reiterated any students eligible for FAFSA can apply and see what loans and scholarships they can receive.

“Applying for FAFSA is a biginconvenience, and when I first started applying for FAFSA I had no idea what I was getting myself into,” said Undeclared Sophomore Jessica Raquel. “Having to reapply every year is annoying even though FAFSA is really helpful in the end” she said.

However, in addition to the cost of attending a California State University such as Sonoma State, there multiple costs that students have to worry about as well such as housing.

Students living on campus, have to pay approximately $6,407 per semester, an amount that differs based on what village one lives in. Meanwhile, students who live off campus pay around $6,717 depending on location.

“The first step [in applying for the FAFSA] is to establish a [federal student aid] ID if you don’t already have one,” said Gutierrez. “Students who have to provide their parents’ financial information on the FAFSA should also have at least one parent establish an FSA ID.”

Gutierrez said a common concern among students is that their families don’t have their federal income taxes completed by the March 2 priority deadline for the FAFSA.

“Having filed federal taxes early and electronically can make the entire application process easier,” said Gutierrez. “However, it’s fine for families to use estimated income if that’s the only way to meet the March 2 deadline.

They can always make corrections after their taxes are filed.”

To apply for the FAFSA, student are encouraged to visit fafsa.edu.gov prior to the March 2 deadline and visit the Financial Aid Office in Salazar Hall with any questions relating to the application and eligibility.